Pan Link With Aadhar: If your PAN Card is not yet linked to your Ayour Adhar card, apply for linking your PAN card with your Aadhar card as soon as possible, otherwise you may have to face a lot of trouble later. If you link your PAN card with an Aadhar card now, you can link it only by paying a late penalty fee of Rs 1000, otherwise, you may have to pay more than this later.

- Important things to keep in mind before Pan Link With Aadhar

- How to check whether Aadhaar is linked to PAN or not?

- Aadhaar pan link process step-by-step

- Step 1: Go to the website of the Income Tax Department and click on Link Aadhaar.

- Step 2: Enter PAN and Aadhaar number.

- Step 3: ‘Verify by providing PAN and mobile number.

- Step 4: Click on the Proceed button in the Income Tax box.

- Step 5: Select Assessment Year and Type of Payment in the New Payment page.

- Step 6: Pay late penalty fee of Rs 1000

- Step 7: Now come back to the home page and request for Link Aadhaar.

- What is an Aadhar Card?

- Disadvantages of not linking PAN-Aadhaar

If you follow the steps mentioned in this article, you can easily Pan Link With Aadhar without any mistakes. After 48 hours of linking your Aadhar PAN, you can also check the Aadhar PAN link status in which the confirmation message of your Aadhar PAN being linked will appear, so let us tell you in detail all the information about PAN Link With Aadhar.

Important things to keep in mind before Pan Link With Aadhar

Many people have different details on their PAN and Aadhar cards. If yours is also like this then it is best that you first get your Aadhar card corrected as per your PAN card or get your PAN card corrected as per your Aadhar card. This means the name and date of birth should be the same in both, no information should be different. If it gets separated then it is possible that your Rs 1000 paid will also be lost and you may have to pay the fee again. Also Read… Aadhar Card & Bank Account Link Status Check Online

How to check whether Aadhaar is linked to PAN or not?

The last date for Pan Link With Aadhar was 30 June 2023 which has now ended. In this way, now you will have to pay a late penalty fee of Rs 1000 to Pan Link With Aadhar, only then you can Pan Link With Aadhar. If you do not PAN link With Aadhar, then your PAN card will become inactive, however, the link Due to lack of availability, a PAN card that is inactive can be activated by paying a late penalty fee, which may take 48 hours to 7 days. But before processing the link, please check whether your Aadhaar is linked to PAN or not.

To know whether Pan Link With Aadhar or not, you can follow the steps given below.

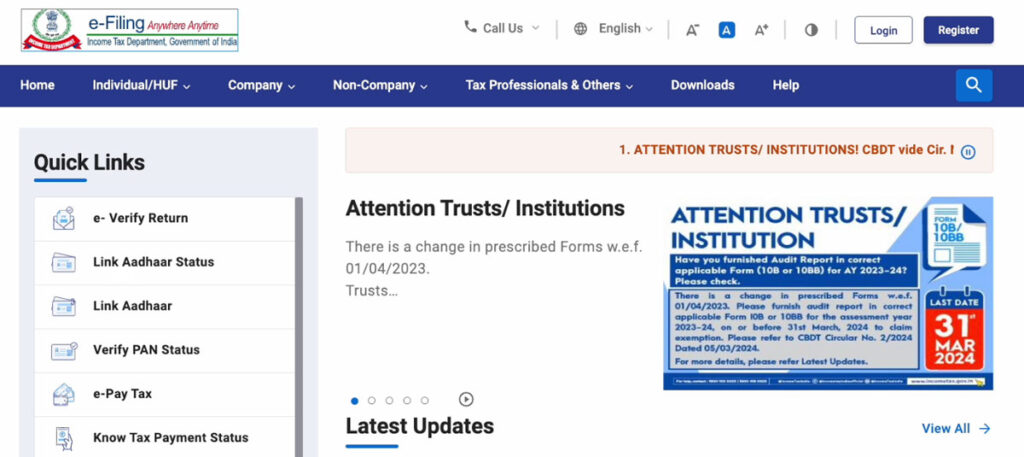

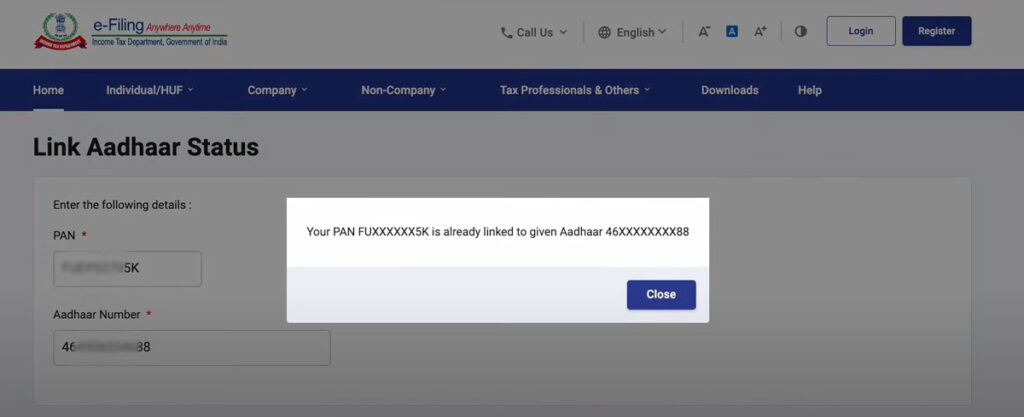

- Visit the official website of Income Tax e-filing https://www.incometax.gov.in/iec/foportal/. After coming to this website, click on the option “Link Aadhaar Status” on the left side.

- Next page Link Aadhaar Status will open, enter PAN and Aadhaar Number in it and click on the “View Link Aadhaar Status” button given below.

- As soon as you click on the View Link Aadhaar Status button, a pop-up will appear in which information about whether your Aadhaar is linked to PAN or not will be written as shown in the photo below.

Aadhaar pan link process step-by-step

Step 1: Go to the website of the Income Tax Department and click on Link Aadhaar.

To Pan Link With Aadhar, first of all, you have to go to the official website of Income Tax. On this website, click on the “Link Aadhaar” option, after which the next page will open.

Step 2: Enter PAN and Aadhaar number.

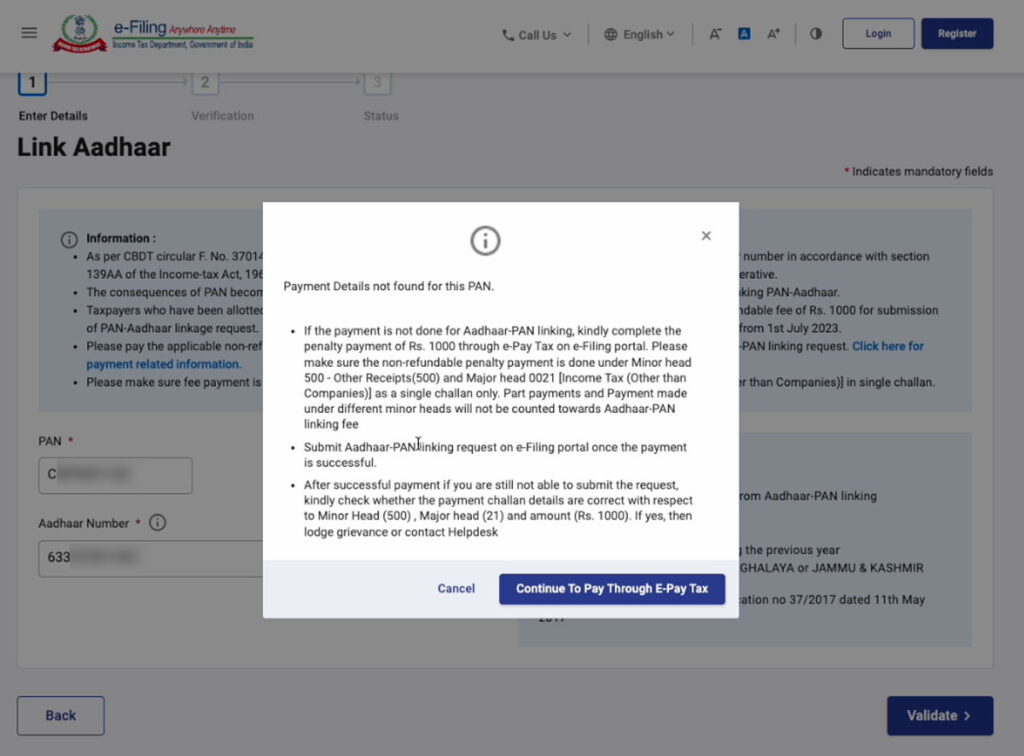

After clicking on the Link Aadhaar option, a new page will open in which gives PAN and Aadhaar Number, and click on the Validate button. After which a pop-up of “Payment Details not found for this PAN” will appear in which you will get Rs. Rs 1000 will be asked to be deposited through the e-Pay Tax e-Filing portal.

Step 3: ‘Verify by providing PAN and mobile number.

Now you have to click on the “Continue To Pay Through E-Pay Tax” button given below and after that again give the PAN card and mobile number click on the “Continue” button and verify with OTP. After which “You have successfully verified through mobile OTP. Click Continue to make a new payment.” Will show the message.

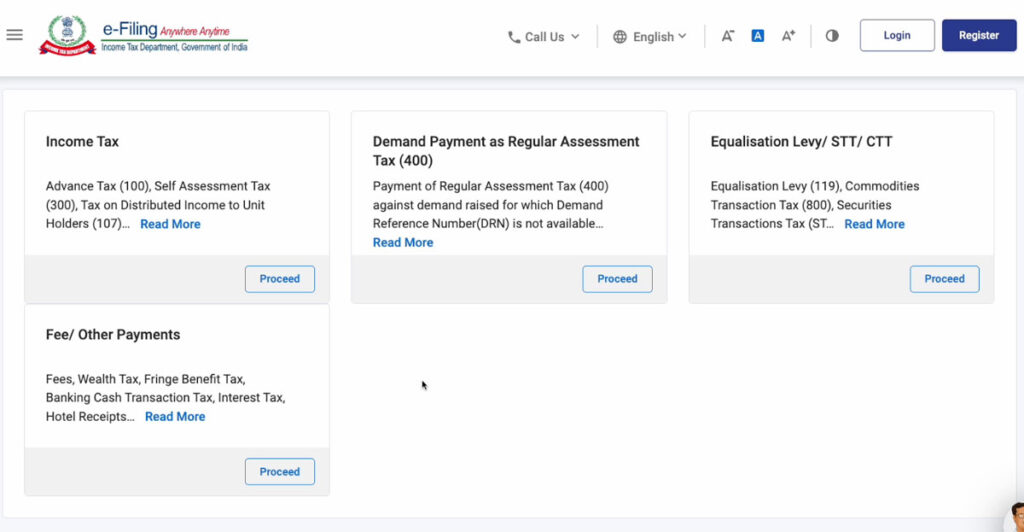

Step 4: Click on the Proceed button in the Income Tax box.

After verifying with mobile OTP, the boxes for Income Tax, Demand Payment as Regular Assessment Tax (400), Equalization Levy/ STT/ CTT, and Fee/ Other Payments will appear on the e-Pay Tax page. Click on the Proceed button in the Income Tax box.

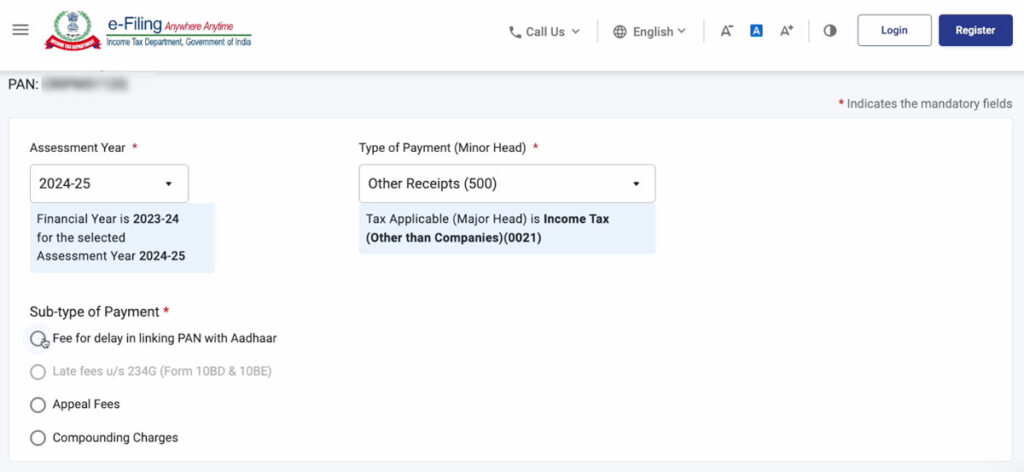

Step 5: Select Assessment Year and Type of Payment in the New Payment page.

In this New Payment page, select the assessment year which is the latest year ‘2024-25’ and in the Type of Payment, select the option Other Receipts (500) and in the Sub-type of Payment option, select “Fee for the delay in linking PAN.” Select the “with Aadhaar” option and click on the Continue option. After which Add Tax Break Up Details will come in and you have to click on the Continue button again.

Step 6: Pay late penalty fee of Rs 1000

After Adding Tax Break Up Details, on the next page, choose the option of Net Banking, Debit Card, Pay at Bank Counter, RTGS/NEFT, and Payment Gateway including UPI and Credit Card to pay the late penalty fee of Rs 1000. Fees have to be paid.

Step 7: Now come back to the home page and request for Link Aadhaar.

After paying the late penalty fee of Rs 1000, you have to come back to the official website of Income Tax e-filing and give a request for Link Aadhaar, after which your PAN card will be linked after 48 hours. After 48 hours, when you check the Link Aadhaar Status option, a confirmation message of the Aadhaar PAN link status will appear.

You can watch the video given below to see all the process step by step.

What is an Aadhar Card?

The Aadhaar card is issued by the Unique Identification Authority of India (UIDAI). In which there is a 12-digit number in the form of an Aadhar card number. This 12-digit number is the identification number of any person. Biometrics, age, gender, and address of the person making the Aadhar card are present in the database of UIDAI. This information is matched while linking it to the PAN card.

Disadvantages of not linking PAN-Aadhaar

Due to not linking PAN-Aadhaar, you may suffer many losses and your work may stop. The biggest problem can arise in filing income tax returns, opening bank accounts, etc.

Why is it important to link my Pan Link With Aadhar?

Pan Link With Aadhar is crucial to avoid potential complications in the future. Failure to link them might result in inconvenience and penalties. It is a mandatory requirement by the government.

What happens if I don’t link Pan Link With Aadhar?

If you fail to Pan Link With Aadha, your PAN card may become inactive, leading to potential financial and legal repercussions. It’s essential to ensure compliance with this requirement.

Is there a penalty for linking Aadhaar with PAN after the deadline?

Yes, if you miss the deadline for linking Aadhaar with PAN, you’ll need to pay a late penalty fee of Rs. 1000. It’s advisable to link them as soon as possible to avoid additional charges.

What should I do if there are discrepancies in the details between my PAN card and Aadhaar card?

It’s crucial to ensure that the details on both your PAN card and Aadhaar card match accurately. If there are any discrepancies, you should rectify them before Pan Link With Aadhar to avoid complications and potential loss of the penalty fee.