Gem Registration Procee: The GeM (Government E-Marketplace) portal has been started by the Government of India to purchase goods required in government offices or to place any order. If you want to take any government order or tender, then it is necessary that your company or business is registered on Gem. In today’s post, I will give you all the information about GeM Registration so that you will easily be able to do gem seller registration in free.

The official website for GeM Registration is www.gem.gov.in. Apart from gem registration, from this website, you can do things like gem portal login, gem tender, gem portal products price list, gem seller log in, and gem bid.

Gem Registration fees

Gem is a government website from where you can register yourself for free. This means gem registration fees is zero rupees. After gem registration, security money has to be deposited which is called gem caution money. People mistakenly consider this gem caution money as gem seller registration fees.

gem caution money is exempted for SC, ST, and women of all categories. The male owner or director of the remaining community will have to deposit gem caution as per the turnover given below…

| Turn Over | Gem Caution Money |

| Less than Rs 1 crore | Rs 5,000 |

| Rs 1 crore to Rs 10 crore | Rs 10,000 |

| More than Rs 10 crore | Rs 25 crore |

If you are not able to do gem seller registration yourself then you can contact a consultant who will do your GEM registration by charging you some consultation fee. You can contact me for a Gem Registration Consultant.

We will provide you with a GEM registration service of just Rs 1500, for which you can contact us on our mobile number 8700042098. Please note that only paid service is provided on the mobile number, free service is not available on the mobile number given by me.

Gem Registration Documents Required

Gem Registration documents list is required on the basis of the company. For example, separate documents are required for a Proprietorship Company and different ones for a Company or Trust. The list of gem seller registration documents list is given below.

Gem Registration documents required for proprietorship firm

If your firm is Proprietorship then you will need the following documents for Gem Registration…

- Adhar Card (Optional)

- pan card

- Bank details

- GST (Optional for Less than 40 lakh turnover firm)

- ITR Return (Optional for Less than 2 Year New Firm)

- MSME(Optional)

- Email id

- Mobile number

Gem Registration Documents Required for Pvt. Ltd Company

- Director Adhar Card (Optional)

- Director Pan Card

- Company Pan card

- CIN (Company Identification Number)

- Bank details

- GST

- ITR Return (Optional for Less than 2 Year New Firm)

- MSME(Optional)

- Email id

- Mobile number

Gem registration process online – [gem seller registration process]

The gem registration process is very easy, which you can do by reading our article, the video of the Gem registration process from our side will be seen below, by watching which you can do Gem registration online.

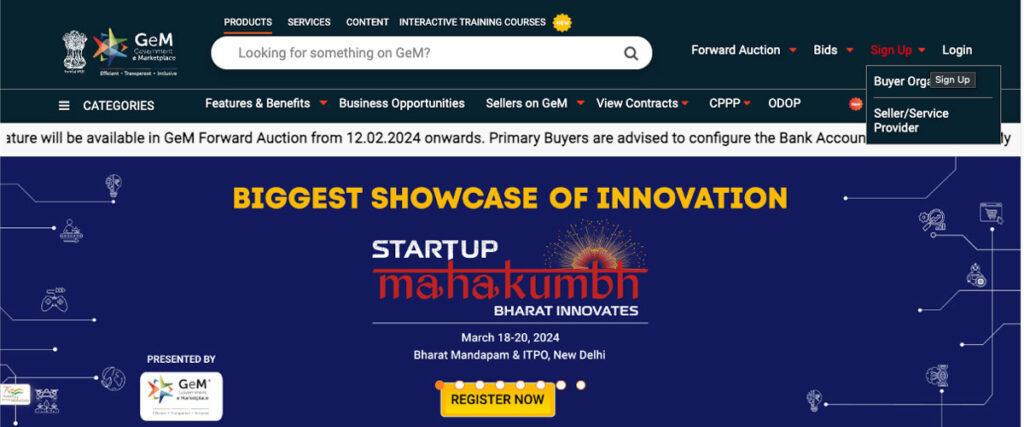

To start the gem seller registration process, first of all, you have to visit the official website of the Government e-Marketplace (GeM) https://gem.gov.in. After visiting this website, you must have selected the Seller/Service Provider option in the Sign-Up option. After which the Gem Seller/Service Provider Registration page will open.

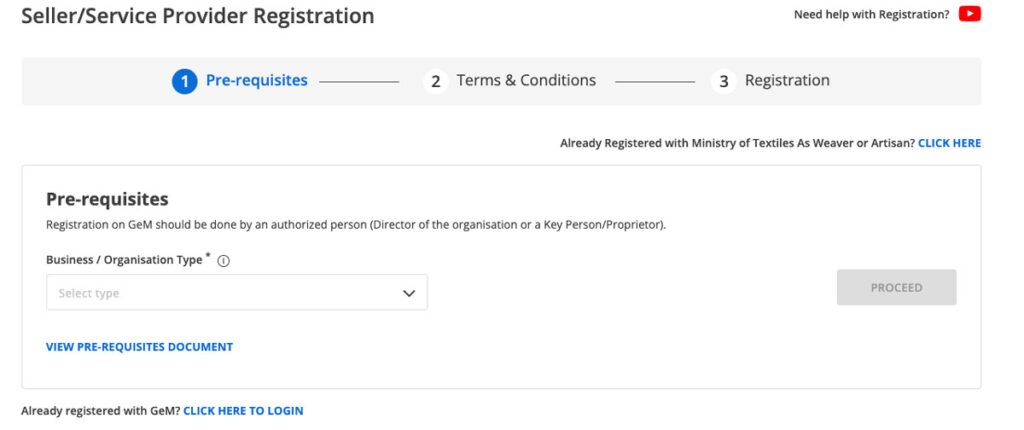

Now you have to select Business / Organization Type in which you will get the option of Proprietorship, Firm, Company, Trust/Society/Association of Persons, and Central Government/State Government. After choosing this, all the options given below have to be ticked.

- Personal Details

- Aadhaar/Virtual ID and Aadhaar linked mobile number OR Personal PAN details with mobile number

- Active Email ID – Personal E-mail ID or Company / Organization allotted Email-Id (to verify OTP)

- Business Details

- Business PAN details (4th character of your PAN number should be P or H)

- Bank account number and IFSC (Not mandatory for Vivad se Vishwas)

- Income tax returns of the last 3 years (It is required for BID participation if your business is older than 24 months) (Not mandatory for Vivad se Vishwas)

- Registered Address (Not mandatory for Vivad se Vishwas)

- optional

- Udyam number for MSME (EMD exemption in BID) (Required for Vivad se Vishwas)

- DIPP number for startup (EMD exemption for eligible startups)

- GST number for inter-state business

For your information, let me tell you that the above option does not mean that you have to provide all the documents. This is just a process to follow. We will tell you the rest in detail further.

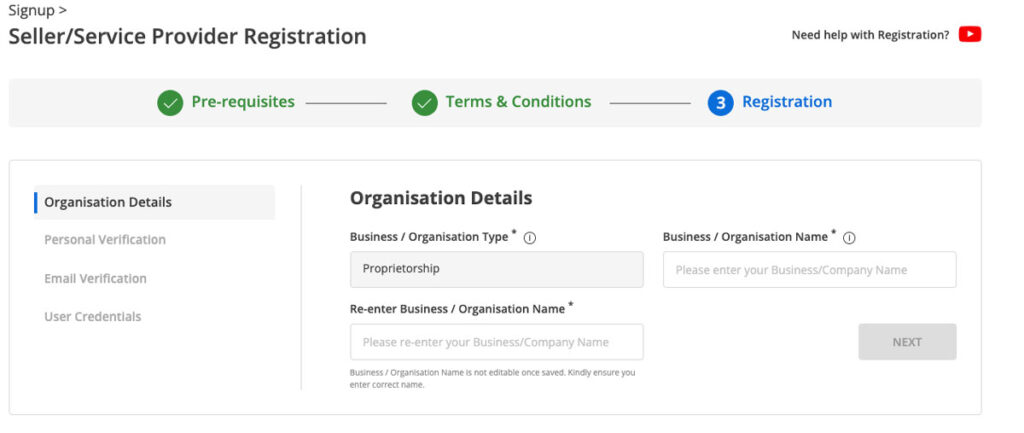

After selecting all the options given above, click on the PROCEED button. On the next page, you have to accept the Terms & Conditions and then click on the PROCEED button again. Now you have to create a Gem Account by providing Organization Details, Personal Verification, Email Verification, and User Credentials.

After creating the Gem Account, all the information given below has to be given. So that your account appears 100% complete.

- Business PAN Validation

- Business Details

- Additional Details

- Office Locations

- Bank Accounts

- e-Invoicing

- MSME

- optional

- Beneficial Ownership Compliance

- Tax Assessment

- Logistics

- TAN Validation

After you give all the above information, your Gem Account will show 100% complete and Gem registration will be done. For specific help watch the video below or call my number 8700042098 for a paid gem registration consultant.

What is GeM (Government E Marketplace)?

GeM is an initiative by the Government of India to purchase goods and services through online tenders and orders from sellers.

Why is GeM Registration necessary?

GeM Registration is essential for businesses looking to participate in government tenders or receive government orders. Only registered entities can engage in transactions on the GeM portal.

How can I register on GeM?

To register on GeM, visit the official website www.gem.gov.in. Select the Seller/Service Provider option in the Sign-Up section. Follow the provided steps, including providing personal and business details, and proceed with the registration process.

What are the GeM Registration fees?

GeM registration is free of charge. However, a caution money deposit, termed as Gem Caution Money, is required post-registration. This money is exempted for SC, ST, and women of all categories.

Is there a fee for the GeM Registration consultation?

While GeM registration is free, if you require assistance, a consultant may charge a consultation fee. Our GeM Registration service is available for Rs 1500, and you can contact us at 8700042098 for paid services.

What documents are required for GeM Registration?

The required documents vary based on the type of business entity.

For Proprietorship: Aadhar Card, PAN card, Bank details, GST (optional), ITR Return (optional), MSME (optional), Email ID, and Mobile number.

For Pvt. Ltd Company: Director’s Aadhar Card (optional), Director’s Pan Card (optional), Company Pan card, Bank details, GST (optional), ITR Return (optional), MSME (optional), Email ID, and Mobile number.

Is Gem Caution Money exempted for specific categories?

Yes, Gem Caution Money is exempted for SC, ST, and women of all categories. This encourages inclusivity and supports businesses from these categories.

Sir mere ko registration Krna hai main new Start krne ja rha hu kuch samjh nhi a rha hai kese Krna hai kya hai mera registration kre gye paid hai i know i will pay the amount of your fee but what type of documents required can you guide me so I can provide you to do the registration of a my company