home insurance India home insurance building | home insurance calculator | home insurance premium | home insurance premium calculator | home insurance policy | home insurance cost in India

Your home being your most important asset, home insurance or property insurance insures the structure and its contents against unforeseen events like natural calamities (hurricanes, cyclones, fires, etc.) or anthropogenic activities (riots and terrorism). The Insurance Regulatory and Development Authority of India (IRDAI) has made it mandatory for every insurer to provide a standard home insurance policy called ‘Bharat Griha Raksha’ with effect from April 1, 2021, which covers loss, damage, or damage to the house building and its contents. Coverage is provided in case of destruction.

Having a roof over the head is very important. Having your own house, many problems are automatically reduced. Along with this, the care and maintenance of your own house are also in your own hands. At the same time, home insurance has also been considered very important to protect your home from any kind of natural calamity.

Due to natural calamities like floods, and earthquakes, there is a lot of loss of life and property. The worst thing is that these disasters never come by telling and when they do come, the scene of destruction is also frightening. Many times, due to natural calamities like floods, and earthquakes, houses and even the biggest buildings have been seen to be grounded. In such a situation, it is necessary to take home insurance to avoid any untoward loss. Our country has been constantly battling with incidents of natural calamities and fires, due to which there is a huge loss. Hence, to avoid huge financial losses due to such incidents, you should buy a home insurance policy.

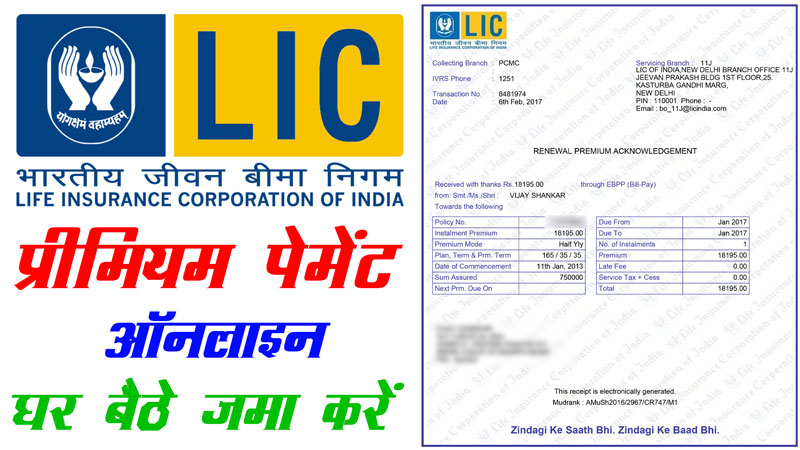

Insurance Policy Buying Online Process 2024

Home Insurance Buy online Important Poaint

| Insurance | कमर्शियल वाहन इंश्योरेंस |

| Mode | online |

| Benefit | Home insurance at a Low price |

| Home Insurance | Click Here |

| commercial vehicle insurance | Click Here |

| Car Insurance Online | Click Here |

| Bike Insurance Online | Click Here |

protective cover for home

Home insurance is like a security cover for the house. With this, along with keeping the house safe, personal things can also be saved from any damage. At the same time, damage can be done by any human being or due to natural reasons. With the help of home insurance, it helps financially in case of any mishap. With the help of a good home insurance plan, most natural calamities like earthquakes, hurricanes, floods, landslides as well as fires or explosions are covered.

कार इन्शुरन्स ऑनलाइन करें 2022 – car insurance online policybazaar

Which plan to choose?

Under a home insurance policy, a plan should be chosen that not only covers the house but also covers the items inside the house like furniture, electrical appliances, and portable equipment. In such a situation, you will not have to suffer much financial loss after arson or theft. At the same time, there are many plans in which insurance coverage is available in case of theft of valuables. Apart from this, if the house collapses in a natural calamity, then the insurance companies give money for the reconstruction of the house.

Comprehensive insurance provides the following cover

- Any damage caused due to fire, flood, earthquake, and other natural or man-made calamities

- Loss of valuables of the house in case of theft

- Covers for jewellery, valuables, artwork

- An additional benefit of rent for alternative accommodation or temporary resettlement

- Additional benefits like replacement of lock and key, the cover of any liability or non-payment of rent, etc.

Structure of the house- A home insurance policy pays for the repair or reconstruction of the house in case of damage caused by any event covered under the policy. While buying insurance for the structure of the house, one should think of getting enough cover to build it.

कमर्शियल वाहन इंश्योरेंस ऑनलाइन खुद से करें – commercial vehicle insurance

Personal belongings- Your furniture, clothing, and household items are covered in case of loss due to fire theft, or any other disaster. Expensive items like jewellery, art, etc. also get covered to some extent. Home policies in India are package policies that have a number of sections that provide multiple covers. A comprehensive home policy also covers fire, riots, theft, damage to household items, and domestic accidents. You can claim for the personal accident under the home insurance package. With this, you can take payment for partial or permanent disability due to an accident.

Also, Read..

Lic Kanyadan Policy 2022 Life Insurance Corporation details

Select Comprehensive Home Insurance Policy

By the way, you are given a separate cover for all the household items for the house. But instead of all this, you should opt for a comprehensive policy in which you get coverage for all types of damages such as insurance, fire, robbery, and terrorist activity.

home insurance claim Process

It is important to keep all your documents safe in one place in order to recover the damages in time. If you want to do this, you can also take the help of an online app. But it is very important for you to always keep all the necessary documents related to your home.

policy bazaar bike insurance third party zero depreciation download renew 2024

You should have all the necessary information before making a claim. Apart from this, the time limit of all insurance companies is also different. That’s why it is important that you know about it, so you can file the claim in time. Along with this, you should also know that changes in your home and neighbourhood also affect your cover. Accordingly, the premium may increase or decrease.