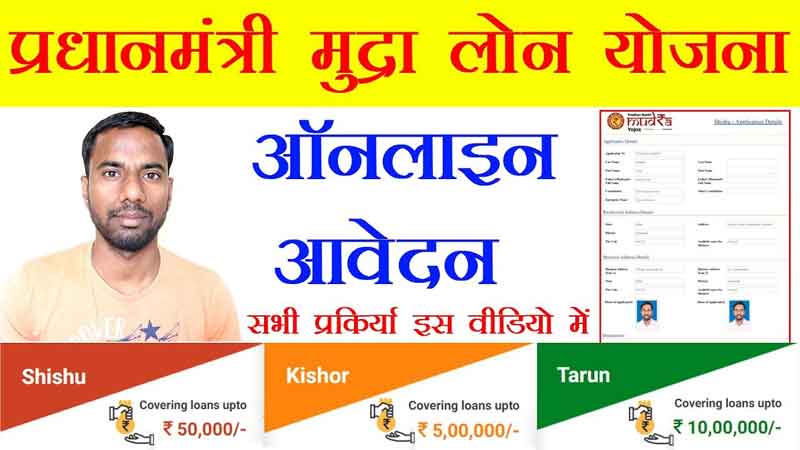

PM Mudra Yojana: Prime Minister’s Mudra Yojana launched by the Central Government. The purpose of which is to provide loans to citizens who want to set up self-employment. Through this scheme, loan facility will be given to all those people who want to start their own employment. them for this PM Mudra Yojana (PMMY) apply online Will have to do This scheme was started by Honorable Prime Minister Narendra Modi ji.

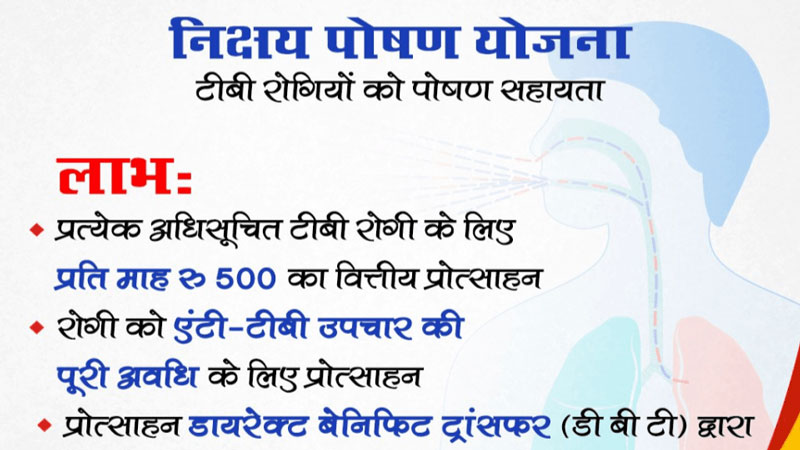

- PM Mudra Yojana 2023

- PMMY: PM Mudra Yojana Highlights

- Purpose of PM Mudra Yojana

- List of Banks under Mudra Yojana

- Facts and Features related to PM Mudra Yojana

- How to apply in PM Mudra Loan Scheme – PMMY

- Prime Minister Mudra Loan Scheme Know the process of offline application here

- When was PM Mudra Yojana started?

- In how many days do I get the Mudra loan?

- What are the types of Mudra loans?

- Which bank gives Mudra loan?

- How to apply for Prime Minister Business Loan Scheme?

- What are the documents required for Mudra loan?

- For how long can I repay the Mudra loan?

- Is there any special Mudra loan scheme for women?

on 8 April 2015 has been done. Today, through this article, we will give you all the necessary information related to this scheme. How to Apply Mudra Loan Online? What are the documents required for Mudra loan and what are the eligibility conditions for it? To know etc., you have to read this article completely.

PM Mudra Yojana 2023

Prime Minister Loan Scheme 2023 Any citizen who wants to take a loan for setting up self-employment. He will be provided loan through this scheme. Which that person can return within 5 years. Through this scheme, this scheme will be very beneficial for the person facing financial trouble in starting his employment.

With this, the applicant can get a loan of up to 10 lakhs to start self-employment. Let us tell you that these loans are of 3 types – Shishu Loan, Kishore Loan and Tarun Loan.

Under Shishu Loan, the applicant will get a loan of up to Rs.50,000. On applying for Kishor Loan, the applicant will be provided a loan of more than Rs.50,000 and up to a maximum of Rs.5 lakh. Whereas citizens who apply for Tarun Loan can get a loan of up to Rs 5 lakh and a maximum amount of Rs 10 lakh.

PMMY: PM Mudra Yojana Highlights

| Article / Scheme Name | PM Mudra Yojana (PMMY) |

| started | on 8 April 2015 |

| initiated | by Prime Minister Narendra Modi |

| type of plan | sponsored by central government |

| purpose | Providing loans to citizens for self-employment |

| beneficiary | Citizens of the country who are willing to start self-employment. |

| official website | mudra.org.in |

Purpose of PM Mudra Yojana

Prime Minister’s Mudra Yojana Through this, the central government is to make all the citizens of the country self-reliant by providing loans to the citizens who want to start self-employment. By doing this not only employment will increase but other unemployed persons of the country will also get employment.

PM Mudra Yojana All those people who want to start their own employment but were not able to do so due to financial constraints will benefit from getting loans under the scheme.

Now it will also be easier for them to start their own employment. With the start of employment, their economic condition will also improve. And along with improving the economic condition, all the people will also become self-sufficient and empowered.

List of Banks under Mudra Yojana

In this article, we are giving you the list of names of all those banks. PM Mudra Yojana come under. You can select the bank from which you are willing to take the loan from the list given here.

- Bank Of Baroda

- State Bank Of India

- Punjab And Sind Bank

- bank of India

- HDFC bank

- ICICI Bank

- j&k bank

- Syndicate Bank

- Punjab National Bank

- Union Bank of India

- Andhra Bank

- Bank Of Maharashtra

- Dena Bank

- IDBI Bank

- Karnataka Bank

- Canara Bank

- Allahabad Bank

- Axis Bank

- Union Bank of India

- federal bank

- Indian Bank

- Kotak Mahindra Bank

- Saraswat Bank

- UCO Bank

- Corporation Bank

- Central Bank Of India

- Tamil Nadu Mercantile Bank

- Indian Overseas Bank

- Oriental Bank of Commerce

Facts and Features related to PM Mudra Yojana

- PM currency There will be a common platform where big financial institutions like RRBs, MFIs, NBFCs, etc can meet the applicants.

- Under PM Mudra Yojana, applicants will be given loans to start their small and micro industries. Which they can return within 5 years.

- For the convenience of the applicants, 3 types of loans have been provided here, in which a minimum amount of 50000 to a maximum of 10 lakhs can be found in the form of a loan.

- Under the scheme, loans will be provided to all those small-scale industries which come under the category of non-corporate industries.

- Prime Minister Mudra Loan Scheme to all the beneficiaries under MUDRA CARD is made available. Which can be used by the beneficiary like other banks atm. You can also withdraw money through this card. All these banks will be valid in ATMs.

Also Read…

- Nazar Andaaz Download [4K, HD, 1080p 480p, 720p] Review

- Simultala Awasiya Vidyalaya Class 11 Admission 2022-24: Online Forms, Dates, Eligibility

- Bihar Pashu Shed Yojana 2022-MGNREGA Animal Shed Scheme: Apply Here

- GoodBye Download [4K, HD, 1080p 480p, 720p] Review

- Maja Ma Download [4K, HD, 1080p 480p, 720p] Review

- List of Competitive Exams and Entrance Exams after 12th

- Balika Durashth Shiksha Yojana 2022 applies Process and Eligibility

- Chief Minister Khiladi Unnayan Yojana 2022 Apply Online, Eligibility & Benefits

- Digital Address Codes 2022 Know how DAC will be issued Full details here!

- Southern Railway Apprentice Recruitment 2022 Apply Online, Notification

These are the eligibility of PM Mudra Yojana

Through this scheme, you can also get a loan for your employment. For this, you have to apply under this scheme. Please read these eligibility conditions prescribed under the scheme before applying. We are passing them on.

- The age of the applicant under the scheme should be more than 18 years.

- The applicant should have a detailed business plan of action. All types of information should be available like the structure of the plan, investment, nature of the product, future results and marketing, etc.

Documents Required for Pradhan Mantri Mudra Loan Scheme

You will need some important documents to apply for this scheme. We are providing you a list of all these documents through this article. You must read them before applying and prepare all your documents.

- Copy of the Aadhar Card of the applicant (self-attested)

- Photocopy of the PAN card of the applicant

- Two passport-size photographs of the applicant (taken within the last three months)

- copy of bank passbook

- age certificate

- Copy of bank statement (last 3 months)

- sales tax return income tax return

- mobile number

- Local / domicile certificate, proof of address.

- Email ID

How to apply in PM Mudra Loan Scheme – PMMY

If you also want to start your self-employment PM Mudra Loan Scheme You can apply under For this, you have to go to the official website set under the scheme. After that, you can apply after registering yourself. Here we are explaining the complete process in detail. You can apply in Mudra Yojana by following this.

- First, you visit the official website prescribed for the scheme www.mudra.org.in go.

- Now the home page of the official website will open in front of you.

- Here you have to scroll up and down Quick Links Click on the option of udyammitra given under.

- By clicking on this option, the website of Udyami Mitra will open on your screen.

- By coming to the option of Mudra Loans from the options given to you here Apply Now have to click.

- After clicking on it, the next page will open in front of you, where you will see 3 options. Out of which you have to choose your category.

- You can choose your category from here. If you are a new entrepreneur then first, if you are already running an enterprise then second, or if you are self-employed then choose the third option.

- Now you have to fill in your name, mobile number, and email id here.

- anymore Generate OTP Click on the button.

- Now OTP will come on your registered mobile number which you will fill in the designated place.

- anymore verify OTP Click on Now you will see the message of completion of registration on the screen. You click on OK.

- In this way, you have been registered. Now after login you have to fill out the application form.

- On your screen as soon as you click on ok Pradhan Mantri Mudra Yojana Online Form Will see Now you have to fill in all the information asked in it.

- Prime Minister Loan Scheme Online Form 2022 In this, you will have to fill in personal information, and professional information such as education-related and other business-related information. after that, you Submit Click on the option.

- You will get a message on your screen where you Get Started Click on the option. then on the next page Loan Application Center Next to Apply now click on.

- After this, the category of Mudra loan will appear on the new page, out of which you will have to go next to the loan as per your requirement. apply now Click on

- Now in the application form, you have to fill in business-related information and other necessary information. Along with this, you will also have to upload all the necessary documents.

- After this, you have to tick a mark in the designated place in the declaration form and I agree to stick to Submit my details Have to click on it.

- In this way, your application process will also be completed.

Prime Minister Mudra Loan Scheme Know the process of offline application here

- First of all, get the loan application form from the concerned bank giving loans under the scheme.

- after this you PM Mudra Yojana Application Form You have to fill in all the asked information.

- After filling in all the information you have to attach all the required documents with the application form.

- After this, you have to submit the application form there to the concerned officer.

- All the information and documents filled in by you will be verified and after verification, you will get the loan within a month.

- In this way, you can apply offline also.

Question and Answer Related to PM Mudra Yojana

When was PM Mudra Yojana started?

start of the plan on 8 April 2015 was done by Prime Minister Narendra Modi.

In how many days do I get the Mudra loan?

You get the Mudra loan within one to 2 weeks to a month after the application.

What are the types of Mudra loans?

There are mainly three types of loans available under PM Mudra Yojana. These are – Shishu Loan (business loan up to 50 thousand), Kishor loan (loan from 50 thousand to 5 lakh) and Tarun loan (loan from 5 to 10 lakh).

Which bank gives Mudra loan?

You get Mudra loan through all private and public banks covered under the scheme.

How to apply for Prime Minister Business Loan Scheme?

To apply under the scheme, you have to visit the official website. After that you can apply. Please read our complete article to know in detail.

What are the documents required for Mudra loan?

2 Passport size photographs (attested within last 3 months), Aadhar card photocopy which has to be self attested, PAN card photocopy (self attested), Bank passbook photocopy (self attested), 3 3 months bank statement and home Documents like photocopy of address proof etc. will be required.

For how long can I repay the Mudra loan?

You can repay within 5 years of getting the Mudra loan.

Is there any special Mudra loan scheme for women?

Yes. This scheme for women Is United Women Entrepreneur Scheme

Through this article, we have given you all the necessary information related to PM Mudra Yojana. Hope you liked it. If you want some more information regarding this or you want to ask anything about this, then you can tell us through the comment box.