Link Aadhar to PAN card Online 2022:- Linking Aadhar with PAN Card has become mandatory because if your Aadhar is not linked with PAN then your Income Tax Return will not be processed. Also, if you have to do banking transactions above Rs. 50,000, you need to link your PAN card and Aadhar Pan card aadhar se link kaise kare Will have to do Linking PAN card with Aadhar card is very easy and for this the government has provided many ways.

The deadline for linking PAN with Aadhar card has been extended till March 31, 2024. However, you will have to pay the fee for linking your Aadhaar with PAN card now. 500 will be charged if the linking is done by 30th June 2022. After this date, you will have to pay a fee of Rs 1,000. Learn in this article below how to link Aadhaar with PAN card online and get your documents linked at the earliest.

Link Aadhar to PAN card Online 2024 Overviews

| Article Name | Link Aadhar to PAN card Online 2024 will be started, now you will have to give 500 to 1000 rupees link like this. Pan card aadhar se link kaise kare |

| Post Type | Aaykar Sampark Kendra(ASK) General Queries Related to Income Tax 1800 180 1961 (or) 1961 08:00 hrs – 20:00 hrs (Monday to Saturday) e-filing and Centralized Processing Center e-Filing of Income Tax Return or Forms and other value added services & Intimation, Rectification, Refund and other Income Tax Processing Related Queries 1800 103 0025 (or) 1800 419 0025 +91-80-46122000 +91-80-61464700 09:00 hrs – 19:00 hrs (Monday to Saturday) Tax Information Network – NSDL Queries related to PAN & TAN application for Issuance / Update through NSDL +91-20-27218080 07:00 hrs – 23:00 hrs (All Days) |

| Departments | Income Tax Department |

| Official Website | https://eportal.incometax.gov.in |

| Pan Card Aadhar Card Link | Click Here |

| Pan Aadhar Linking Status | Click Here |

| Pan Aadhar Linking Fee | 500 will be charged if the linking is done by 30th June 2022. After this date, you will have to pay a fee of Rs.1,000 |

| Helpline Number | Aaykar Sampark Kendra(ASK) General Queries Related to Income Tax 1800 180 1961 (or) 1961 08:00 hrs – 20:00 hrs (Monday to Saturday) e-filing and Centralized Processing Center e-Filing of Income Tax Return or Forms and other value added services and intimation, Rectification, Refund, and other Income Tax Processing Queries 1800 103 0025 (or) 1800 419 0025 +91-80-46122000 +91-80-61464700 09:00 hrs – 19:00 hrs (Monday to Saturday) Tax Information Network – NSDL Queries related to PAN & TAN application for Issuance / Update through NSDL +91-20-27218080 07:00 hrs – 23:00 hrs (All Days) |

PAN Card Kya hota hai

Pan card online apply Pan Card is a unique identification card called Permanent Account Number Permanent Account Number (Ex.ABCDS1234J). Which is very important in any kind of economic transaction. The alphanumeric number in the PAN card is a 10-digit number, which is issued by the Income Tax Department. Issued under the supervision of the Central Board for Direct Taxes (CBDT). PAN Card Full Form Permanent Account Number (PAN) happens. This is a unique identity card and it is considered very important in any kind of financial transaction.

Pan Card Importance and Use

Very useful for buying or selling property

It costs less to buy or sell a vehicle

Transactions above Rs 50,000 are required only

A PAN card is also required to open an account in all banks.

Transaction of shares above Rs.50,000 is required

For new connection of telephone

Amounts exceeding 25,000 are required to be paid in a hotel

In today’s time, a PAN card is an important ID given the increasing business. It is an ID to give proper details of the income of the person like payment of regular tax. Some changes such as the death of a person or closure of the organization are necessary to give proper information to CBDT in time.

Benefits of PAN card? Benefits of PAN Card

PAN card is beneficial for taxpayers

Linking Pan Card to Salary Account is beneficial

A PAN card can be applied anywhere in India as an identity card.

PAN card also saves you from tax-related hassles

Pan cards are useful in all types of jobs like part-time, full-time.

Pan Aadhar Link New Update & Guidelines

Linking a PAN card with an Aadhar card is very easy and for this, the government has provided many ways. The deadline for linking PAN with Aadhar card has been extended till March 31,. However, you will have to pay the fee for linking your Aadhaar with your PAN card now. 500 will be charged if the linking is done by 30th June 2022. After this date, you will have to pay a fee of Rs 1,000. Learn in this article below how to link Aadhaar with a PAN card online and get your documents linked at the earliest.

Also Read…

- DDA Recruitment in Various Categories

- Major Download Filmyzilla Review 480p 720p 1080p

- samrat prithviraj download filmyzilla Review 480p 720p 1080p

- Bihar Pacs Member Online Apply

- Haryana Bhavantar Bharpayee Yojana 2022 Online Registration, Status, HBBY

- Rajasthan Tarbandi Yojana Apply

- Bihar Ration Card Rejected List online check

- Ashram 3 download filmyzilla Review 420p 720p 1080p MX Player

- Soil Health Card Registration – soil health card sample registration form

- Nirmal Pathak Ki Ghar Wapsi download filmyzilla Review 480p 720p 1080p SonyLIV

Pan Aadhar Link Kaise kare Online

How to Link PAN Card to Aadhaar Card Online through e-Filing Website

People can get their PAN and Aadhaar linked online by following the steps given below:

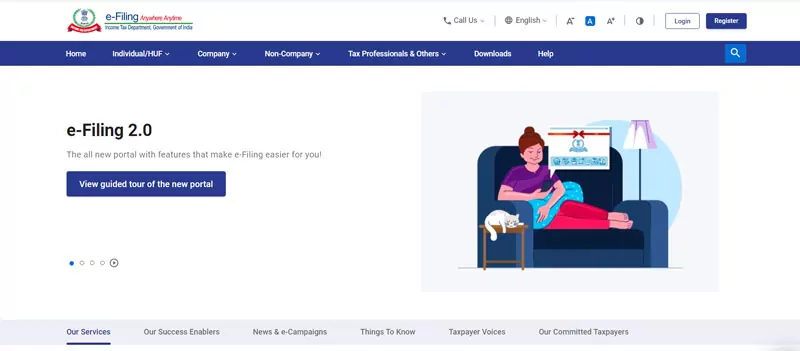

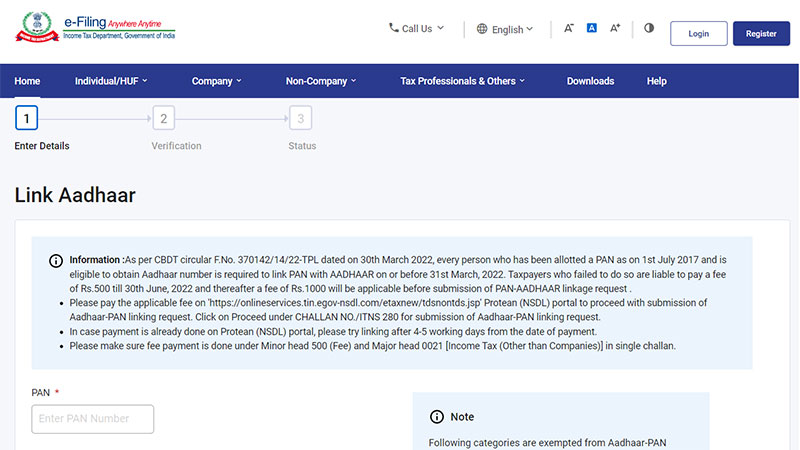

Phase 1, Income tax e-filing website Go to and under Quick Links’Link AadharClick on ‘Options’

Phase 2, Enter your PAN and Aadhaar Number

step 3, Enter the name mentioned in your Aadhar card

step 4, If the date of birth is mentioned on your Aadhar card then you have to tick the box

Step 5, Tick mark ‘I agree to validate my Aadhaar details with UIDAI’

Step 6. Click on ‘Link Aadhaar’ button

Step 7, Next, enter the OTP received on your mobile number and click on ‘Validate’.

Step 8, A pop-up message will appear showing Aadhaar successfully linked with your PAN card

Correction Facility for Linking PAN with Aadhaar Card

PAN and Aadhar card linking is successful only if all your details in both documents match. If you have spelling mistakes in your name, your PAN will not be linked with Aadhaar. You can make changes by visiting the nearest Aadhaar Enrollment Center or through the portal of NSDL PAN. If there are any errors in your PAN card, you can fix them by following these steps:

Phase 1: The user can correct his/her PAN details using the NSDL website

Phase 2:NSDL link redirects to the page where you can apply for correction of your name

step 3: Submit the signed digital document to update your PAN details

step 4: Once your details are corrected in your PAN and confirmed by NSDL by mail, you can link your PAN with Aadhaar.

Google search term: how to link pan card to aadhar card, how to link aadhaar card with pan card, pan card ko aadhar se kaise link kare 2024, how to link pan card with aadhar card,aadhar link pan card online,aadhar card,pan card ko aadhar se kaise link kare, pan card link aadhar card,aadhar link pan card,aadhar card ko pan card se kaise link kare,link pan to aadhaar online, pan card aadhar card link,pan card se aadhar card kaise link kare, how to link pan card with aadhar card in mobile

How to Check the Aadhaar Card and PAN Card Linking Status

To check PAN-Aadhaar link status, follow the steps given below:

Step 1: Go to the e-filing page of Income Tax Department i.e. https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/AadhaarPreloginStatus.html

Phase 2: Select ‘Link Aadhaar Status’ under ‘Quick Link’

step 3: Enter your PAN Number

step 4: Enter your Aadhar Number

Step 5: Now, click on the button ‘View Link Aadhaar Status’

Step 6: Your Aadhaar-PAN link status will appear on your screen

Pan Card Link Aadhar 2024 Links

| Pan Aadhar Linking Status | Click Here | |

| Pan Link Aadhar | Click Here | |

| Download Pan Card | NSDL | UTIITSL |

| Reprint Pan Card | NSDL | UTIITSL |

| E-filling Pan Card | Click Here | |

| Pan Card Application Status | NSDL | UTIITSL |

| Apply Online | NSDL | UTIITSL |

| Official Website | NSDL | UTIITSL |

link aadhar to pan card online

link aadhar to pan card online income tax

link aadhar to pan card online status

link aadhar to pan card online not working

pan card aadhaar link online last date

link aadhar to pan card by sms

link aadhar to pan card through sms

link aadhaar card to pan card online nsdl